capital gains tax canada real estate

05 of the value up to and including. In 1921 capital gains were classified separately.

Capital Gains Losses From Selling Assets Reporting And Taxes

How to avoid capital gains tax in Canada when selling property Tips to minimize or eliminate your capital gains tax in Canada.

. For instance if you buy a property. When an inheritance occurs capital gains. Your tax bracket which is determined by your total US.

A capital gains tax CGT is a tax on the profit realized on the sale of a non-inventory asset. The federal capital gains tax on real estate began in 1913. Ontario 3 potential taxes Land transfer tax Provincial.

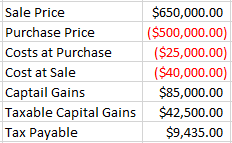

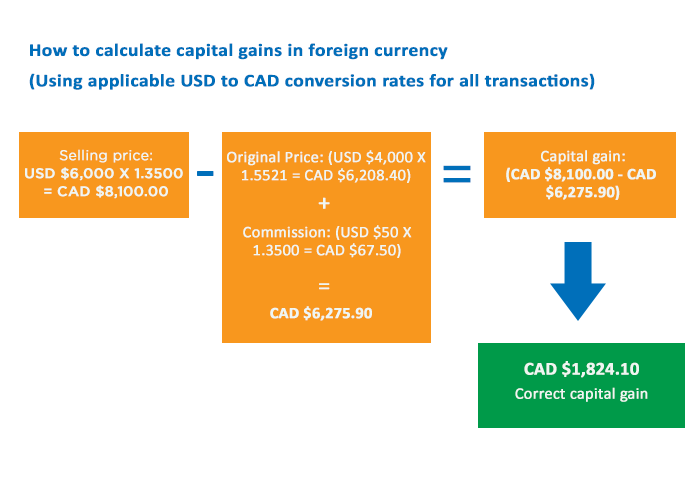

Capital Gains Tax in Canada. Now let us look at a simplified example of how to calculate capital gains on investment real estate. To calculate your capital gain or loss you need to know the following 3 amounts.

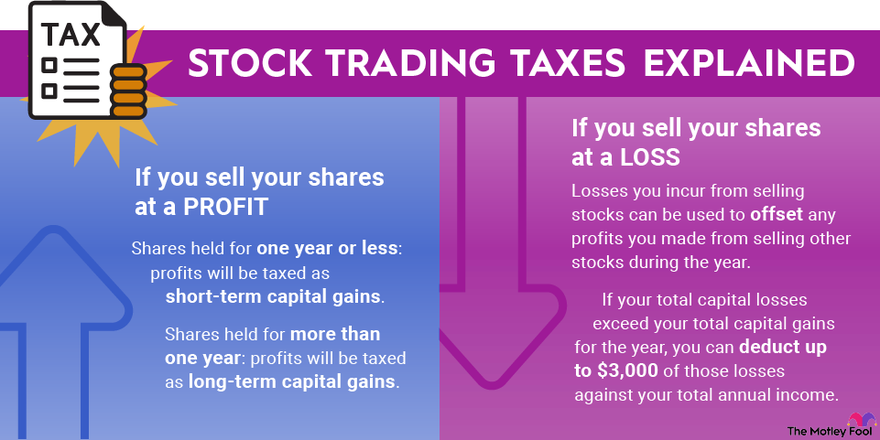

All of Canadas tax treaties permit Canada to tax gains on direct interests in Canadian real estate that are owned by non-residents 6. You realize a capital gain when you sell a capital asset and the proceeds of disposition exceeds the adjusted cost base. In Canada capital gains are taxed at a rate of 50 of the gain if the asset is sold within one year of it being bought and at a rate of 2667 if the asset is held for longer than.

The most common capital gains are realized from the sale of stocks bonds. Rental property both land and buildings farm property including both land and buildings other than qualified farm or fishing. Real estate includes the following.

Multiply 5000 by the tax rate listed according to your annual income minus any selling costs. Principal residence and other real estate. When you sell your home you may realize a capital gain.

The proceeds of disposition. For the purposes of this example well assume the. How to Reduce Your Capital Gains Tax in Canada on Real Estate.

Though the inclusion rate is the same for everyone there are certain ways to lower the amount of tax on. Income as well as your filing category ie single married filing jointly or head of household. The tax liability for capital gains in real estate is determined by the difference between the propertys cost basis and the sale price.

When you sell a capital property for more than you paid for it this is called a capital gain. While the same rules apply to all gains and losses from real. You must pay taxes on 50 of this gain at your marginal tax rate.

You pay this tax one time when you purchase a property in Ontario. Below are the federal tax brackets for 2022 which can give you an idea of how much tax you may. Calculating Capital Gains Taxes.

The adjusted cost base ACB the outlays and expenses incurred to sell your. You must report the sale on. If you earned a capital gain of 10000 on an investment 5000 of that is taxable.

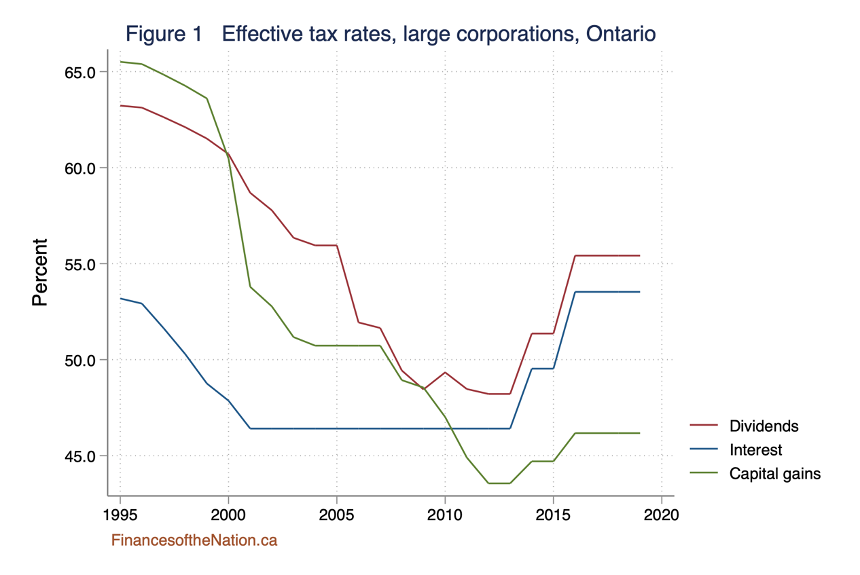

Line 12700 - Taxable capital gains. At that point they were taxed as a form of income with a maximum rate of 7 percent. Under the Act 50 of capital gains are included in income.

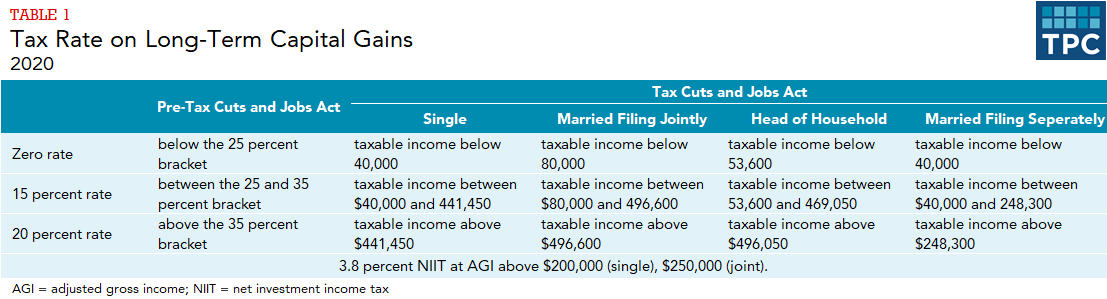

Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600 or. Capital gains are taxed as part of your income on your personal tax return.

Savings And Investment Oecd Capital Gains Tax Retirement Accounts

How To Avoid Or Lower Capital Gains Tax Owed

Tax Implications Of Canadian Investment In A Florida Rental Property

Selling Stock How Capital Gains Are Taxed The Motley Fool

Capital Gains 101 How To Calculate Transactions In Foreign Currency

:format(webp)/https://www.thestar.com/content/dam/thestar/business/opinion/2022/02/26/the-50-per-cent-inclusion-rate-on-capital-gains-benefits-mostly-the-rich-its-time-to-bump-it-up/capital_gains_tax.jpg)

The 50 Per Cent Inclusion Rate On Capital Gains Benefits Mostly The Rich It S Time To Bump It Up The Star

Tax Profit As Income Or Capital Gains

It S Time To Increase Taxes On Capital Gains Finances Of The Nation

Canada Taxation Of International Executives Kpmg Global

How Are Capital Gains Taxed Tax Policy Center

/CreatingaTax-DeductibleCanadianMortgage1_3-bbe7be25ea614913b8e8351756c52239.png)

Creating A Tax Deductible Canadian Mortgage

How To Cut Your Tax Bill With Tax Loss Harvesting Charles Schwab

Avoid A Tax Nightmare Capital Gains Tax On Your Principal Residence I New Rules Youtube

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

How To Avoid The Capital Gains Tax On Rental Property In Canada

Canadian Change Of Use Rules For Cross Border Real Estate Cardinal Point Wealth Management

How Is Capital Gains Tax Calculated On Real Estate In Canada Accounting Firm Toronto Gta Accounting Professional Corporation

New Rules Capital Gains Tax On Your Home The Independent Dollar

You Could Still Qualify For A Capital Gains Tax Break After Selling A House You Ve Owned Less Than 2 Years Marketwatch